Well, we all want to live the American dream, don't we? Since childhood, every one of us dreamt of living in this alluring country. Now that we have grown up, we still think about it but in a mature and a practical way. Many people opt to pursue higher education to go to the USA and after completion of the course, they take up a job and settle near a nice neighbourhood and experience the wintery morning of this most sought-after destination for Indian students seeking education opportunities abroad.

America is one of the few countries in the world which offers many benefits of higher education. But the biggest challenge one always faces for studying in the USA is to arrange or funds. The cost of living and studying in a country like the USA can be exorbitant and not everyone can afford it. In this scenario, an education loan for the USA might seem a feasible option.

The USA offers a variety of courses and a typical master's degree cost around 40 lakhs. This figure can be expanded up to over a crore, It all depends on the course you opt for. If you are still confused as to whether to take an educational loan or not, whether to take education loan in India by govt or private lender. That's why, to solve your dilemma here is a quick reminder- you’ll reap more interest than what you will be paying for your education loan.

Some other benefits include- personal savings remaining untouched, tax savings, repayment after graduation and self-dependence. Now that you’ve made up your mind. Let's have a quick glance at the types of loans available. Broadly, education loans for the USA fall under two brackets:

Secured Education Loans

These are the education loans with collateral where you will have to pledge an asset to the lender as a security in order to get an education loan.

Unsecured Education Loans

These are the student loan in India without collateral where you do not need to pledge any security to the lender in order to avail of the education loan. A co-applicant and his/her income is the major basis of the loan sanction. Let's delve into the types of lenders offering US education loans to Indian students. We are inching towards the American dream. Your patience is demanded.

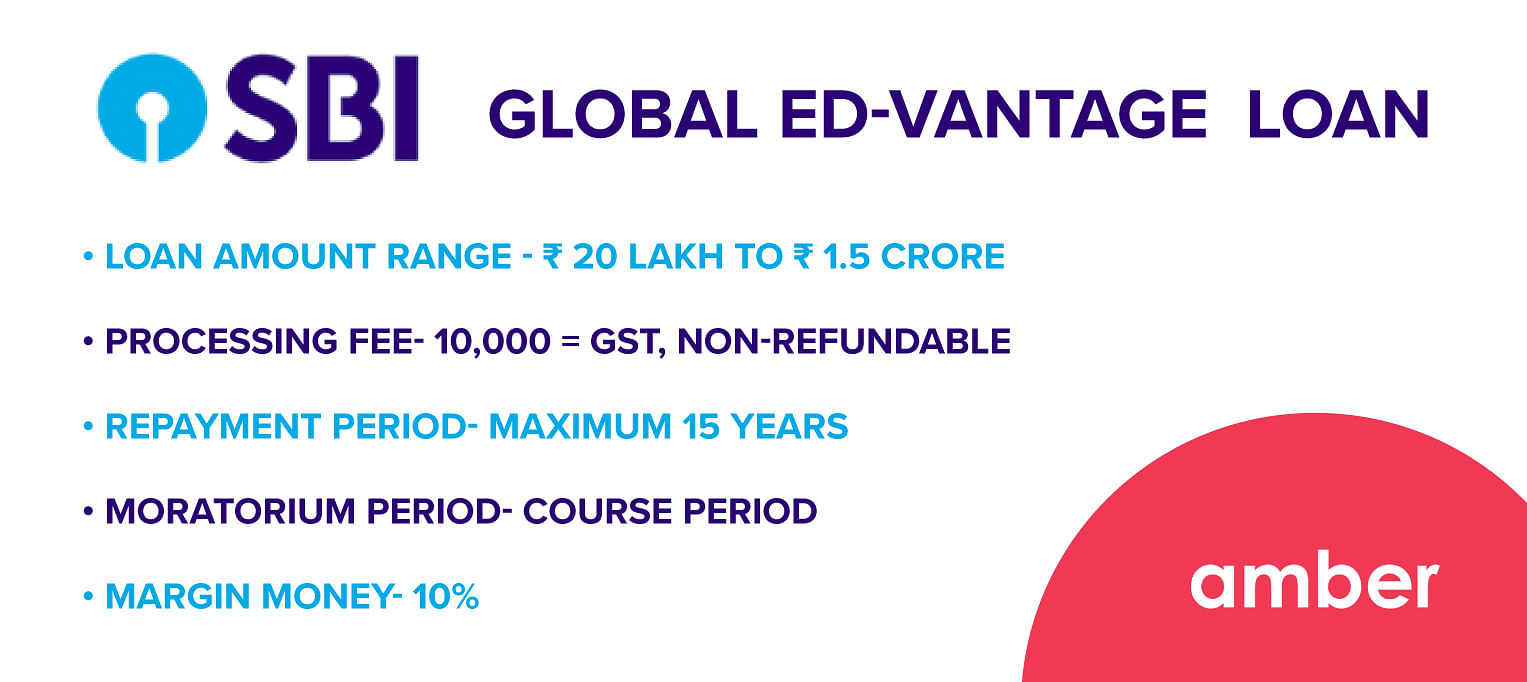

State Bank of India: SBI is a government-backed financial institution which provides education loan in India by govt. Their services are known for diligent paperwork and is often regarded as the best education loan in India for study abroad. has a Global Ed-Vantage scheme for Indian students for offering overseas education loans including USA. The minimum loan amount is INR 20 lakhs and maximum is INR 1.5 crore. Loan can be repaid in 15 years and the EMIs start after 6 months of the course completion. Check out this guide to SBI education loan for studying abroad.

To avail this loan, collateral is required as it falls under the secured loan category. Co-applicant’s profile is not very important. 0.5% rebate is also offered on the interest rate if you buy SBI Rin Raksha insurance in your loan plan.

Bank of Baroda Scholar: Bank of Baroda is one of the top public-sector banks for overseas education loans for all countries including America. BOB has a list of premier institutions in which there are primarily the educational institutions in America. BOB education loans have a 100% margin for these listed colleges, 6 months of moratorium period, and low-interest rate.

There are mainly 4 types of lenders that provide education loans to study in the USA:

Private-sector banks

Axis Bank: The maximum amount offered as student loan in India is up to INR 40 Lakhs if listed in the Prime A category of colleges. The interest rate typically ranges between 11.5% to 12.5%p.a. There is zero margin money if the college is listed under Prime A and Prime B category.

The applicable moratorium period is up to 12 months after the course completion and there is no prepayment penalty. The minimum co-applicant income should be 35k with no prior loans and EMIs pending. Axis Bank also provides secure loans at 85% of residential collateral value. To know more, visit their website.

ICICI Bank: The maximum loan amount that can be taken as student loan in India is up to INR 40 Lakhs if listed in the A1 category of colleges. The interest rate starts at 10.5% p.a. If listed under the A1 category of colleges.

Similar to Axis Bank, there is no margin money if the college is listed under the A1 category. The Applicable moratorium period is up to 6 months after the course completion and there is no prepayment penalty. To know more, visit ICICI Bank’s website.

Non-banking financial companies (NBFCs)

HDFC Credila: HDFC Credila is one of the best bank for education loan in India. Though it is not an education loan in India by govt, but it is one of the highly secured ones. The maximum loan amount that can be taken in the form of an education loan without collateral from HDFC Credila is INR 50 Lakh. The rate of interest ranges from 11% to 12.5% p.a. The processing fees 1-2% of the loan amount and there is no prepayment penalty.

Avanse Financial Services: Avnase is one of the top NBFCs in India and provide a wide array of study loan in India. The maximum loan amount that can be taken from Avanse is INR 40 Lakhs. The rate of interest ranges from 11.75% to 16% p.a.

Students have to pay a simple interest or partial interest during the study period and the principal repayment starts 6 months after course completion or 3 months after getting a job (whichever is earlier). The processing fees charged is usually 1% of the loan amount (plus GST) and there is no prepayment penalty.

InCred: Incred can offer a student loan in India of up to INR 40 Lakhs without collateral. The rate of interest ranges from 11.75% to 16% p.a. Applicants have to pay a simple interest or partial interest during the course period. The maximum loan tenure can be up to 10 years. The processing fees charged is usually 1% to 1.25% of the loan amount (plus GST) and there is no prepayment penalty.

Auxilo: Auxilo is another option for study loan in India. The maximum loan amount that can be taken from Auxilo is INR 40 Lakhs (case-level exceptions are possible). The rate of interest ranges from 12.70% to 18% p.a. The processing fees charged is 1% to 2% of the loan amount (plus GST) and there is no prepayment penalty. To know more, visit their website

International lenders

MPOWER Financing: MPOWER Financing offers some of the best education loan in India for higher studies in the US and Canada. The loan is offered in USD and CAD and no co-applicant or collateral is required. The maximum loan amount that can be taken in the form of a student loan in India without collateral from MPOWER Financing is up to USD 100K.

The rate of interest is around 11.99% for graduate courses and around 13.99% for undergraduate courses. There is no margin money involved and the repayment tenure can be up to 10 years.

Prodigy Finance: Prodigy is a UK-based financial lender that offers student loan in India based on an applicant’s academic profile- without any collateral or co-applicant. The loan is offered in USD. The rate of interest is around 9.4%

There is no margin money involved and the repayment tenure can be up to 20 years. The repayment starts after 6 months of the course completion and no repayment is required during the moratorium period. Check out this blog to know the student loan eligibility.

Frequently asked questions

Q.1 What is an education loan?

A: An education loan is an amount you borrow from either banks or private lenders to fulfil your needs as a student. These sums are generally sought for higher education and/or specialised courses in esteemed institutes located overseas or domestically..

Q.2 Who can avail of an education loan?

A: Educational loan is available to both full-time graduate and postgraduate student. Each lender has a different policy for providing loans to students who pursue various courses. Study loans in India can be availed for management, engineering, medical law, architecture, etc. The candidates going abroad for higher studies mostly get a student loan in India irrespective of their subject of study.

Q.3 What documents do I need to submit to avail an education loan?

A: The list of documents that must be submitted to avail of a student loan in India are:

- Liabilities and assets of all the borrowers

- Proof of identity

- Proof of address

- Income Tax Returns that are less than 2 years old

- Passport-size photographs (two)

- Foreign exchange permit

- Letter that confirms the scholarship.

- Course expenses

- Admission proof

- Relevant mark sheets.

Q.4 Which are the best education loan in India?

A: Most banks and financial institutions provide education loan in India for studying abroad. Banks such as HDFC, Bank of India, SBI, Punjab National Bank, and many other private lenders like InCred provide study loans in india.

How does GyanDhan help?

With GyanDhan, you can skip all the hurdles in your way to getting the best student loan in India product as per your profile. With its streamlined education loan process, GyanDhan offers free help in study loans for the USA and several other major countries.

Its education loan counsellors will discuss the loan options available to you after understanding your academic and financial profile. GyanDhan works in partnership with several leading lenders, including public sector banks, private banks, and NBFCs. So if you are also looking for an abroad education student loan in India, get in touch with GyanDhan now!

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)