Before diving into the SBI education loan for studying abroad, let’s delve into the factors leading to the rise of the popularity of the SBI student loan. With the rise in competition in the job market, the need for an advanced degree has been accentuated way higher than ever before. Now, students want to complement their higher studies with a degree from a foreign university since this makes a substantial difference in the overall outlook. Even short-duration courses have high-yielding value. Earlier, this used to be an uphill task. Still, banks have developed structured schemes to provide loans for education abroad at very reasonable interest rates and a feasible repayment process. This is something that has made a significant difference in the education lending ecosystem. Finding the right education loan for abroad is one of the biggest challenges for students, and the SBI education loan for studying abroad comes as a sigh of relief.

What Is SBI Foreign Education Loan?

A SBI student loan for studying abroad is a loan designed for students to help pay for their education and any other expenses. The SBI education loan for studying abroad includes tuition fees, books, supplies, and student accommodation. The SBI student loan for international students can differ from other loans as an education loan has a substantially lower interest rate, and the repayment schedule can also differ when the students are still in school, college, or university.

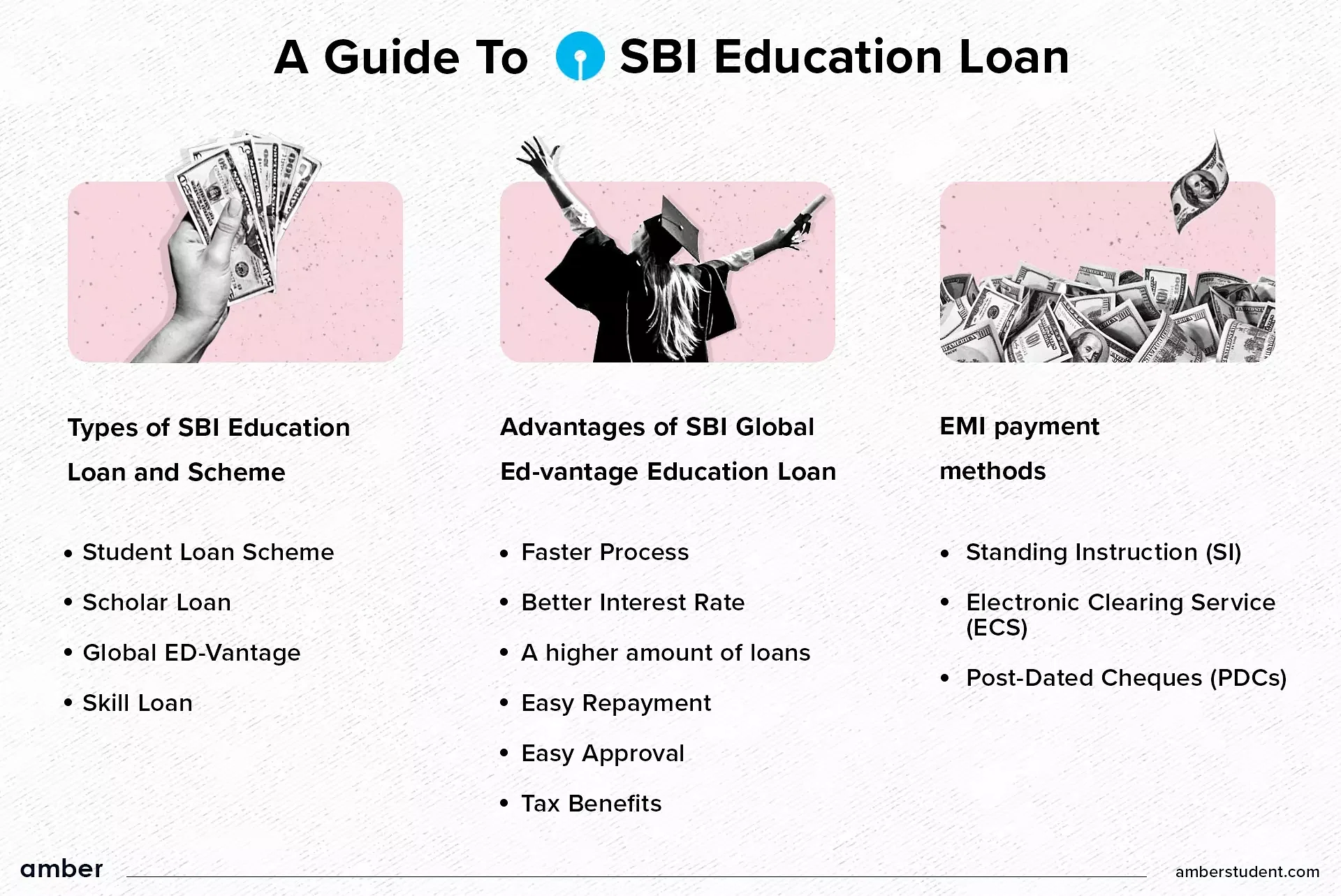

SBI education loan for studying abroad also differs from country to country, and the bank and the government generally decide these rules regarding their respective banking systems. When it comes to defining an SBI student loan for abroad, there are four types of SBI education loans. Below are some of the SBI education loans for abroad studies:

1. SBI foreign education loan for studying abroad for undergraduate students

2. SBI student loan catering to postgraduate education

3. Parents availing of SBI foreign education loan

4. SBI education loan for studying abroad and Career Growth

SBI Student Loan For Abroad: A Brief

State Bank of India (SBI), a Fortune 500 firm, is a Mumbai-based statutory institution for India's public sector banking and financial services. Founded in 1955, SBI is the bank that Indians have had the most faith in because of its lengthy history, which spans more than 200 years. SBI is the bank that Indians have had the most faith in because of its lengthy history, which spans more than 200 years.

SBI Global ED-Vantage

The SBI education loan for studying abroad is a loan for international studies that is only available to people who want to enroll in full-time, regular courses at foreign institutions and universities. Additionally, under this programme, students may apply for a loan before their I-20 or visa has been accepted. The processing fee for an SBI education loan for studying abroad is Rs. 10,000/- per application. Below is the list of expenses covered in the SBI education loan for abroad studies:

1. Payable to the university, institution, or hostel.

2. Examination, library, and lab fees.

3. Travel and passage costs.

4. Stationary or computers necessary for the completion of the course ( maximum 20% of the total tuition fees due upon course completion)

5. The amount that is being evaluated for a loan for caution deposits, building funds, or refundable deposits supported by institutional invoices and receipts should not be more than 10% of the total course tuition.

Advantages Of SBI Education Loan For Abroad

The SBI Global ED-Vantage loan programme is only intended for students who wish to study abroad. Following are some advantages of obtaining your student loan through the SBI Global ED-Vantage loan programme:

1. Faster Process

Because this is an online application process, it becomes faster and easier for applicants.

2. Better Interest Rate

You get attractive and better SBI loan interest with SBI, with 10.2% for male students and 9.7% for female students after insurance. These SBI interest rates will be beneficial while repaying the loan.

3. Higher Amount of Loans

You can get an SBI education loan for studying abroad from Rs. 20 lakhs up to Rs. 1.5 crore. You will not have to worry about putting some money out of your pocket.

4. Easy Repayment

You can repay your SBI student loan for abroad via various modes of EMI payment for up to 15 years with a better SBI foreign education loan interest rate

5. Easy Approval

With an SBI student loan for abroad, you can get your loan sanctioned before i20/visa.

Types Of Interest Subsidy Schemes On SBI Foreign Education Loan

The SBI Student Loan Scheme offers borrowers an interest subsidy of 1% on loans up to Rs. 20 lakhs for overseas education. Borrowers can also avail a 0.50% interest concession if they repay the loan amount on time. Below are some of the types of interest subsidy schemes on SBI foreign educational loans:

1. Dr Babasaheb Ambedkar Scheme Of Interest

The goal behind the SBI student loan for abroad via the program is to give deserving students from the Other Backward Classes and Economically Backward Classes interest subsidies so they can have greater possibilities to pursue higher education overseas and improve their employability.

2. Padho Pardesh Scheme Of Interest Subsidy

The scheme's major goal and ambition is to give deserving students from economically disadvantaged groups in registered minority communities interest subsidies. The reason for subsidy through the scheme on the SBI student loan for abroad is to increase their employability and give them greater possibilities for higher study abroad. It is a great find if you are looking for financial assistance in higher studies.

SBI Student Loan For Abroad Criteria

There are a number of criteria to be eligible for an SBI foreign education loan, so you must be careful. The eligibility criteria start from your nationality and run down to your merits and LOA from universities. If you are thinking of seeking an SBI student loan for abroad regarding higher studies, the below-mentioned list of SBI student loan for abroad criteria might help you:

1. You must be an Indian citizen to apply for this loan

2. Achieved admission to overseas universities/institutions; Secured admission to professional/technical courses in premier colleges through entrance exams/selection processes.

3. No minimum qualifying marks are stipulated in the last qualifying examination.

4. If it is a scholar loan, you should have secured it in select premier institutions of the country.

5. You can check out the specific eligibility for SBI Take-over Education Loan.

Know more about educational loans in a student’s life in our blog on Education Loan Eligibility Criteria and Required Documents.

SBI Foreign Education Loan Rules

SBI student loan has various plans for repayment and has a halt time of course duration and six months following completion of your course. The student can choose not to make any payments during this period. SBI’s policy for education loans starts post this time frame for both the SBI Candidates Loan Scheme and the SBI Global Advantage Scheme.

In many other private banks and NBFCs, a student is required to make a partial contribution to your total interest while your studies abroad are still in progress. These usually don’t have a time frame where a student can wait and gather funds.

Many students have questions regarding the pre-closure charges and if they will be levied on their candidate loans. For example, if a candidate gets an SBI education loan for studying abroad for a time frame of 15 years, he can choose to pay the loan in 5 years, and he will not be charged any extra charges. This is one of the added advantages of SBI’s Global Advantage Fund, where pre-closure charges are not levied.

How To Apply For SBI Education Loan For Studying Abroad

There are a number of steps to take care of before applying for an SBI foreign education loan. Below are some of the most important steps to procure an SBI student loan:

1. Initially fill in the online application form for an SBI education loan.

2. Submit all your documents required for an SBI education loan for studying abroad to the nearest branch in your region.

3. The branch then gathers the reports and sends them to the processing facility.

Documents Required To Apply For SBI Education Loan

The SBI education loan for studying abroad has very strict requirements for documentation, and you must look into it in depth. Applicant’s documents required for SBI education loan for studying abroad:

1. SBI education loan for studying abroad application form

2. Passport

3. Proof of identity, which includes your Driver’s Licence, Voter ID card, PAN card, and Passport.

4. Proof of residence, which includes a copy of your electricity bill, piped gas bill, aadhar card, Driving license or a copy of your passport.

5. Two passport-size photographs

6. Copy of academic qualifications such as 10+2 certificates, Degree certificates, etc

7. Ranking certificate of University

8. The result of your entrance examination like GRE/TOEFL/GMAT/IELTS, etc.

9. Schedule of expenses of the course

10. Gap certificate (if applicable)

11. Proof of admission

12. You will also need the documents if you have taken a loan in the previous year.

Co-Applicant’s Documents Required for SBI Education Loan

1. Proof of residence, which includes a copy of your electricity bill, piped gas bill, aadhar card, Driving license or a copy of your passport.

2. Proof of identity, which includes your Driver’s Licence, Voter ID card, PAN card, and Passport.

3. Two passport-size photographs

4. Latest salary slips (past three months)

5. Income Tax Returns (last 2-3 financial years)

6. Form 16 document (at least from the past two years)

7. If self-employed, then Profit and Loss statement

8. Bank account statements for the past six months

When Should You Apply For An SBI Student Loan?

The ideal time to begin the SBI student loan application procedure is as soon as your acceptance to a university is verified. The earlier you begin the student loan application procedure, the better! Don't wait until you hear back from every university you apply to, please! Don't wait till you've made up your mind on which university to attend! As soon as one admission has been confirmed, you should begin the loan application procedure.

Your SBI education loan for studying abroad processing time will be greatly shortened by doing this! Sometimes, you may need to take care of formalities that are incomplete or have missing documentation. Therefore, the easier it will be for you to secure an education loan, the earlier you start.

Types Of Security For SBI Global ED-Vantage Education Loan

The State Bank of India, under their SBI Global ED-Vantage Scheme, accepts the following security against the education loan amount:

1. Tangible collateral security

2. Collateral security offered by Third Party (other than parents) would also be considered

EMI Payment Methods For An SBI Foreign Education Loan

There is a moratorium period of the course duration plus six months under the SBI Education Loan Policy plan. There is no requirement to pay anything at this time. For the SBI education loan for studying abroad, that is, the SBI Global ED-vantage Scheme, your loan payback period starts six months after the end of the course, and the loan is up to 15 years (maximum). The SBI Education Loan Rate is set, making it very simple to determine your monthly EMI. You can also use the SBI education loan EMI calculator. You can pay back your SBI education loan for studying abroad in the following ways:

1. Standing Instruction (SI)

The best method of repayment if you have an existing account with SBI is by standing instructions. Your EMI payment will be automatically debited from the SBI account you designate at the conclusion of the monthly cycle.

2. Electronic Clearing Service (ECS)

If you have a non-SBI account and want your EMIs to be automatically deducted from it at the end of the month, you can pay your SBI education loan for studying abroad via this method.

3. Post-Dated Cheques (PDCs)

You can deliver post-dated EMI checks from a non-SBI account to the SBI Loan Center that is closest to you. It will be necessary to submit a new set of SPDCs promptly. Please be aware that Post Dated Cheques will only be accepted at non-ECS locations.

SBI has been a trusted bank since 1955; being trusted by millions, you can rest assured that you can mindlessly apply for a loan here. We hope this blog helped you with all the information required for the SBI education loan for studying abroad. Don’t let anything come between you and your dreams. Find more information about student loans in our comprehensive guide on paying-off student loans early to make sure you do not hamper your studying abroad journey.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)