As students are starting their new year in college, it is quite possible that some of them might have taken admission with the help of a student loan, as it is quite normal for students to panic and overthink about student loan repayment. We can only imagine how ‘taxing’ this whole process might be. One can use many tips and tricks to conduct a smooth and hassle-free student loan repayment. So let us help you out here. Let’s take a look at some student loan repayment tips you can try so that your 30s are spent unbothered by debt.

How Do You Manage Student Loan Debt?

One can easily manage their student loan debt and have smooth student loan repayment by following some easy steps mentioned in this blog. Student loans are quite infamous, but this is not the case. One can easily have a smooth student loan repayment if they have timely and well-organised payments. You can always use these student loan tips to help you manage them. If you are still unsure of how to manage your student loan debt then read our blog on tips for student loan management.

What Happens if You Do Not Pay off Your Student Loans?

If you don't pay your student loans, it is always considered a bad financial situation and a bad financial practice. Student loan repayment is important as one may not get financial aid when needed, and their credit score is also badly affected. As well as, the interest rates will keep going up, and one can also have loan sharks behind them. In order to maintain the Status Quo one has been following, it is important that a student pays their student loans.

How long should it take to pay off student loans?

Student loans are usually quite a burden for students, and they tend to pile up and create financial constraints. There are two types of student loans - federal student loans and private student loans. Both these categories differ in interest rates and payment plans. It is recommended that you complete your student loan repayment in 10 years as that is how much time the banks and federal institutions provide, although it takes a certain individual around 21 years to repay their student loan debt. There are quite a few students who pay off their loans by paying a larger amount each month. However, that is not recommended as it can also affect your future financial plans.

Is it smart to pay off student loans early?

This always depends on the amount of money you are making. Student loan payments can be paid in a variety of ways. You can always choose to clear out your student loan payments in a lump sum or also pay while you increase the amount every week, but all of these depend on a varied amount of cases like

- If you are saving a good amount of money for your retirement.

- If your income is high enough to fund your other goals.

- If you have paid off your higher-interest debts like credit card bills and housing loans.

Pros of paying off student loans early

There are quite a few pros of paying off your student loans early. You can always choose to pay a higher amount every month as when you pay off your student loans. in the end, you tend to accumulate a lot of interest and doing your student loan payments early can help you not pay extra. You can also gain a headstart when you pay off your student loans early as there are fewer payments, and you can achieve your other financial goals, such as buying a house or a car or even finally taking your dream vacation. This also helps in increasing your debt-to-income ratio as you pay them off in a higher amount each month. The interest rates tend to go down, and you can reduce your debt while this gives you a headstart in the future, you can use the money you are earning as you direct them to other sources of income or spending.

Cons of paying off student loans early

As there are pros to paying off your student loans early, there are many cons too. As a student pays a lump sum of money, they tend to have increased monthly payments, and one can face financial constraints because of this as it is quite a big sum of money. If you have been accepted for forgiveness, there is no point in paying a lumpsum amount of money. You can continue making minimum student loan payments after your set time of the loan. The student debt gets forgiven. As you pay off your student loans early, this can also take your focus away from your other financial obligations and goals, which can lead to other problems in the future. You can also read more on our blog on “Should I pay off my student loans early?”.

Student Loan Repayment Methods

As one can calculate how their EMIs can be set, these are methods to repay your student loan there are methods like EMI. Where one can set up monthly payments, which can be paid off with interest, and one can easily sort their financials out in this method. One can also opt for part payment, where one can pay a lump sum of their amount on a regular basis and at intervals, where one has the option to save money and pay it. Student loan pre-payment is also a popular option among students where students can pay the full amount of their loan, which results in them not having the hassle of paying the loan later.

Student Loan Repayment Modes

As the banking sector has evolved and there are quite a few ways for students to pay their student loans where one can choose to deposite their payments through cheque or a demand draft. As cash is one of the most popular modes of payment, it is always easy to pay by cash, but the only downside is that one may have to wait in line in the bank, and it can be time-consuming at times. Automated EMI payments of student loan repayment are always a safe option if you have a different bank account for your loan maintaining a balance in the same account is always advised as one does not have to worry about going through all the fields again while repaying.

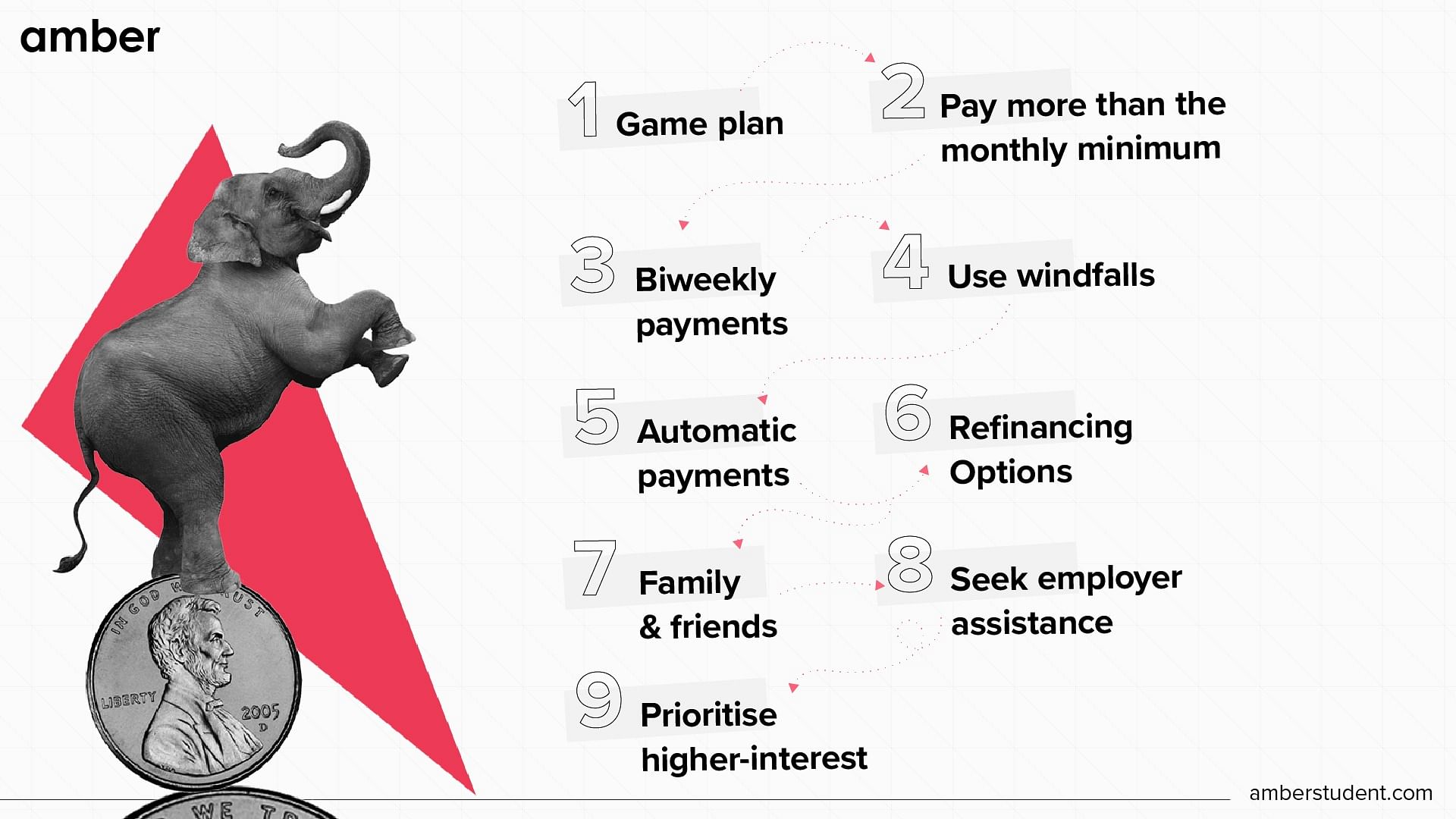

Student Loan Repayment Tips

Student loan repayment is the process of repaying your student loans, and there are many ways to do that. Student loans can surely be a burden for many people, and repaying them can surely be a tedious task for many as it is a huge sum of money. Student loan repayment usually involves monthly payments, and one also needs to give interest on it. As students don't usually land jobs as soon as they are out of the university, these repayments are always pending for many. This eventually turns into debt, and one has a lot of issues paying them. Now that we have confirmed that student loan repayment is a burden, it’s time to dive into the various ways to get through it.

Have a game plan ready!

Understand the whole student loan repayment, including the tax advantages and principles. Before making the decision to repay, be aware of the financial value of each component and take time out to make a timetable. This plan should not be more than five years and not so low as to make it impossible to achieve and ultimately cause the strategy to fail. A suitable time span could be between two and four years, requiring you to determine how much you want to pay each month.

Pay more than the monthly minimum, the right way.

It for sure is a difficult task to repay and do student loan management. Often, our first paycheck is insufficient to cover this cost. But a silver lining you shouldn’t ignore is that you might not be required to make loan payments while in school and for a short while after you graduate because your loans are deferral. But unfortunately, aside from Subsidised Direct Loans, interest continues to accrue during this period.

Make biweekly payments

A majority number of students just make one monthly loan payment. But if you make bi-weekly payments, you will, however, end up paying more over the year and will eventually reduce your payment period.

Here's how it would work! Say, for example, you do the monthly student loan repayment in two equal instalments every two weeks. A half-payment every two weeks would result in 26 payments throughout the year. This equates to 13 total payments each year and only making 12 payments over the course of the year if you pay once per month. You could reduce your interest payments and pay off your debt much sooner by making bi-weekly payments.

Reconsider Your Repayment Plan

Changing to a shorter repayment period will help you pay off student loans more quickly. The monthly cost will typically be greater for shorter repayment terms, so you must ensure you can afford the new amount before switching.

Federal loan borrowers can choose from many different student loan repayment options. For more information on the plan you are currently enrolled in, log into your Federal Student Aid (FSA) account. The 10-year standard or graduated repayment schedule is the shortest period available, so you can adjust your payback schedule if you are not enrolled in any of those plans and are not working toward loan forgiveness. To make things easier, it is possible to see how your student loan repayments would change for each plan using the official FSA loan simulator.

Put your windfalls to use!

Consider directing your windfalls toward your student debts if swiftly getting out of debt is your main objective. A windfall is any financial gain that you weren't anticipating. Unexpected cash such as tax returns, inheritances, and bonus pay are a few examples of windfalls.

Determine how much of a windfall you will put toward your debt. Your other objectives or expenses will further influence the amount you select. You also need to prioritise taking care of immediate needs before considering adding to your emergency fund. Save on your student maintenance loan by using this windfall to your benefit.

Sign up for automatic payments.

Federal student loan servicers may lower your interest rate by .25 percentage points if you set up autopay. Many private lending providers also offer a comparable discount. This may not seem like much, but even a slight decrease in your interest rate might make it simpler for you to pay down more principal and pay off your debts earlier. Even a slight rise in interest rates could significantly impact your debt if you owe a lot of money. For instance, this method could be helpful if you're attempting to find out how to pay off $100,000 in student loans quickly.

Research Refinancing Options for student debts

If you have high-interest student loans, refinancing can help you pay them off more quickly. You can find a new lender with better conditions or a cheaper interest rate by refinancing your student loans. To determine how much refinancing could save you, use a refinancing calculator.

Consider a $40,000 loan with a 7% interest rate and a 10-year duration. You must pay $465 each month. Your new monthly payment will be around $545 if you refinance to a 7-year term and a 4% interest rate, an increase of $80. This way, you'll save a whopping $9,800 in interest and pay off your loans three years earlier.

Refinancing has drawbacks, especially if you have federal loans, as refinanced loans turn into private loans and lose all of their advantages, such as income-driven repayment plans, extended forbearance and deferment periods, and loan forgiveness programmes.

The government has also stopped collecting federal student loan repayments and frozen interest rates since the Covid-19 outbreak started. The same clause does not cover private loans. You could refinance the private loans to a lower interest rate while keeping the federal loans in place if you have a combination of federal and private loans. You might get the best of both worlds with this.

Support of family and friends

Consider asking your friends and relatives for assistance with loan repayment if you feel comfortable doing so. In place of holiday gifts, for instance, you could always ask if they might be okay to offer you money toward your student loan repayment.

Seek loan repayment assistance

A growing number of employers offer student loan repayment assistance. If you're looking for options for how to pay off your student loans fast, it may be wise to consider this in your job search. If you can find an employer that gives you money towards your student loan repayment, this extra cash can help pay down your principal balance more quickly so you can become debt-free ASAP.

Pay off the high-interest loan first

If you have several loans, concentrate your extra payments initially on the ones with the highest interest rates. This will enable you to pay off your more costly debt as soon as possible, making it less expensive to repay what you owe. That might make it simpler to pay off debt more quickly.

How to pay off your student loan debt quickly

You can always choose to pay a lump sum amount and clear them while paying a minimum interest amount. One can always choose to pay a higher amount each month where one can easily pay off their student loan in months. It takes an individual around 10-30 years to pay off their student loan debt. It is always recommended that one has their financial goals in mind and one should always make sure they have money for future expenses and endevours.

A great career is built on a foundation of education. However, studying at prestigious universities around the world may be expensive, which is why education loans are so important. Therefore, to make the process as smooth as possible, you must be prepared to make decisions about your student loan repayment by understanding the risks and ramifications of these eventualities. Remember that, no matter what you do, it's always best to be proactive and aim to reach an agreement rather than allowing your debts to become late - or, worse, default. You can always refer to these tips for student loan repayment to help you in the future. You can always have a thorough plan, from getting a student loan to the selection of the best student loan providers for a smooth repayment experience. We wish you the best of luck in your future endeavors!

.jpg)

.jpg)

.jpg)

.png)

.jpg)