A student loan is a common buzzword that every student faces once in their life. Depending on your goals, these funds help you study in the country or abroad. Used for education purposes, student debt comes with separate loan structures and added features. And the most common of all is their complexity. So why not pay off your student loan faster?

Why should you pay off student loans early?

Paying off student loans early can help you become debt-free, increase your credit score, prevent interest costs, and bring peace of mind. You can spend more of your income on other things and follow your goals and desires without being limited by debt. Many student loans are structured in a way to accommodate you, but the truth is, they tend to leave out the terms you actually understand. Large financial jargon and a lengthy contract are all that require a reader to skip and sign simply.

How to pay off student loans faster?

With tuition fees crossing over £9,000 and hefty interest charges, your student loan is bigger than ever. That’s why such financial matters require a simple check-up before signing up. And if you avail one, you should know your options to repay that debt. All of this can cause distress and anxiety. So to help you out with that, here is a simple guide to finding everything you should know about your student loan repayment and where to look while searching for ways to do it.

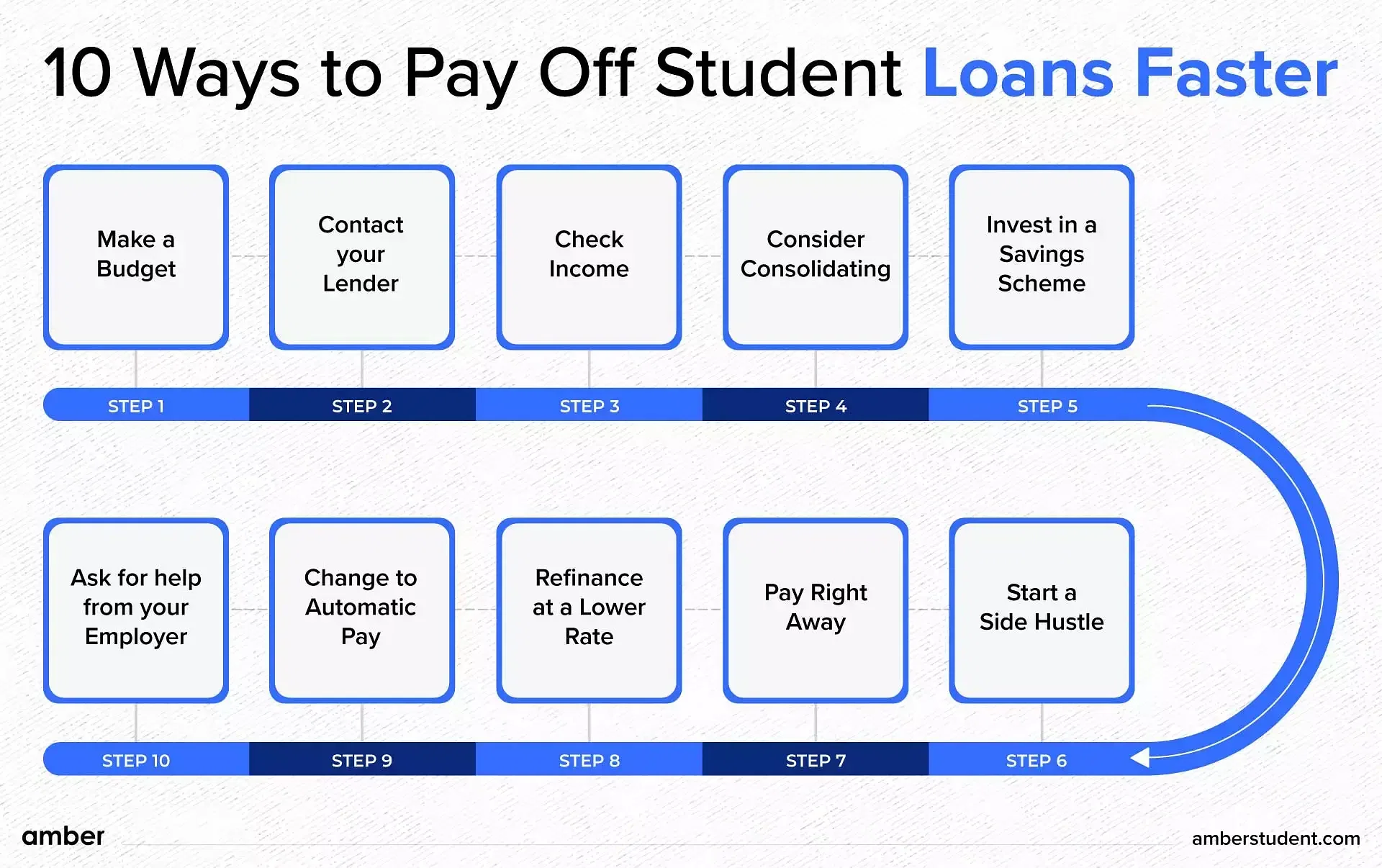

10 Ways to pay off student loans faster

Student loans can be a burden if not handled correctly. Generally, it is said that it’s better to pay off student loans faster than you, and there are many reasons why that is beneficial. Here are some of the best ways to pay off student loans faster:

1. Make a budget

Cutting off unwanted spending is a fantastic approach to saving some money in your monthly budget. Learn how to live economically while still having a good time as a student. Make use of the extra money to lessen your student loan debt. If the money in your monthly budget is insufficient to pay off student loans, you may need to make sacrifices such as eating out less or going on fewer dates Consider taking the time to calculate how much money will be left over after paying off your student loans if you clearly understand what is coming in and going out each month. This method will surely help you to pay off student loans faster.

Don't know how to plan the perfect budget for yourself? Here is a short guide to budgeting for students!

2. Contact your lender

Many students are scared of a defaulted loan while searching for employment. Students looking for jobs can contact lenders to rearrange their instalment amounts. This can be done to accommodate their personal expenses like accommodation, rent, groceries, etc. Adjustable student debt allows you to pay smaller instalments today and larger instalments afterwards. While this offsets the burden of heavy instalments each month, the total principal amount is shaved off at a lower rate. Shorter principal amounts being paid could leave you ending with long-duration interest charges in the long run. One major way to tackle it is to start job-hunting early and then slowly build your skills to earn early promotions or higher pay grades.

Booking accommodation the first time? Check these Common rental frauds and ways to avoid them.

3. Check your eligibility for Income-Based Repayment

Income-based repayment is an effective way to reduce your obligations based on your discretionary income. The amount you earn after taxes and personal necessities (Food, housing, and clothing) falls under discretionary income.

Under the latest norms, income-based repayment is eligible for borrowers having high debt relative to their income. These can be:

- Borrowers with Direct Subsidized and Unsubsidized loans

- Subsidized and Unsubsidized Federal Stafford loans

- Student PLUS loans and consolidation loans—but not PLUS loans made for parents.

The IBR plan is currently available to 1.6 million eligible participants and enables you to pay in either 10% or 15% of discretionary income, depending on your borrowing date. The instalment is capped under a 10-year Standard Repayment Plan and also supports eligibility for Public Service Loan Forgiveness after 20-25 years.

4. Consider consolidating

Loan consolidation is the best-known solution to repay your debt at a constant interest rate. If you have multiple student loans by chance, loan consolidation allows you to club all of these debts and pay back sums based on the average of interest rates on the loans being consolidated. You can also enrol in a graduated-payment program while in consolidation (and in some other circumstances) that allows you to pay increasing amounts over time. The best way to determine whether you should opt for loan consolidation is via the Student Loan Borrower Assistance Project of the National Consumer Law Center. By doing this, you’ll successfully pay off student loans faster.

5. Invest in a savings scheme

Investing in a savings scheme is one of the best ways to pay off student loans faster. It's easier to plan your financial stability if you have some liquid funds available. You can either bring your indebtedness down or invest it in a savings account or other savings instruments by leveraging these funds. But, how do you choose the right one between the two? A simple calculation is assessing the interest paid vs interest earned. If your funds earn more interest than being paid to your student loan, go for a savings scheme. This will help you moderately pay off the debt over time without burdening yourself. Meanwhile, if your investment is earning less than the interest paid to your student debt, it is wise to bring your debt burden down. This will also bring your overall repayment period to lesser months/years and leave you debt-free much sooner than expected.

6. Start a side hustle

You can easily take up a part-time job or a side hustle to earn extra cash to pay off student loans faster. Think about doing something like delivering food or driving for Uber and using that money you earned to make additional loan payments. Rent out your extra room, parking space, or car, or use your skills as a freelancer or consultant on the side. You may even sell stuff like apparel, old gift cards, or photos. Taking up a side hustle will surely prove to be beneficial.

Developing a personal debt budget is one of the best ways to pay off student loans faster, as it will prevent you from spending too much in instances when you feel like it. Personal student budgets enable you to check your expenses while maintaining regular instalments in a systematic plan.

7. Pay right away

Even if it's not compulsory, think about paying off student loans while you're in school or during your grace period. If at all possible, strive to make a monthly payment that is at least sufficient to cover the interest you are paying. In this manner, when you begin your student loan repayment, less interest will become capital and be added to your main sum.

8. Refinance at a lower rate

If you can find a lower interest rate, refinancing can help you pay off your student loan faster. You may be able to reduce the main balance on your loan more easily if you reduce interest charges. By refinancing, several student loans are replaced with one private loan that, ideally, has a reduced interest rate. Select a new loan term that is less than the amount of time left on your existing loans to expedite repayment. Your monthly payment can increase if you choose a shorter term. However, it will enable you to pay off the debt more quickly and save on interest.

9. Change to automatic pay

Enrolling in autopay is a fantastic strategy to pay off your student loans faster and on time while avoiding damaging your credit score. Your student loan servicer will automatically withdraw your monthly loan payment from your bank account if you enrol in automatic debit. This ensures that your payments are made on time, and you can also be eligible for an interest rate reduction for registering. To find out if your loan qualifies for this interest rate reduction, get in touch with your loan servicer and pay off your student loans early.

10. Ask for help from your employer

It's an extra benefit that helps you to pay off your student loan fast and permanently. In an effort to keep talent, businesses are willing to offer such advantages to their employees. So, inquire with your employer about possible student loan repayment assistance. It frequently comes with your salary. Many companies offer assistance to new hires, especially if you are employed on campus. Consult your HR. If you are sceptical and have the ability to barter, you can always make a request prior to accepting the employment offer. This is a benefit that you can discuss.

With more, you also have a window of opportunity to navigate between your essential and non-essential burdens and streamline your monthly/annual budget. By such methods, your student debt will be paid without compromising your lifestyle or cravings. Amber is devoted to giving you the best experience and options for student accommodation worldwide because we understand its value. Paying off your student loans faster can help you in taking responsibility for your money and pursue your goals and objectives without being constrained by debt by lowering your debt load, enhancing your credit score, preventing interest charges, attaining financial freedom, and giving you peace of mind. If you want to know more, here are a few tips on hassle-free student loan repayments!

You can also go through these tips on how to get out of bad debts in our webstory.

.jpg)

-p-1600-compressed.jpg?w=1600)

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)